Editor’s Note: Ideas from HFI Research is a separate paying subscription from the main HFI Research subscription.

By: Jon Costello

Note: Dollar values are in Canadian dollars unless otherwise specified.

Spartan Delta (SDE:CA) reported news last night that validates our investment thesis for the name. Recall that SDE is a two-part thesis. The first part pertains to its attractive natural gas assets in the Deep Basin, which endow it with some of the greatest cash flow torque to natural gas prices among North American E&Ps.

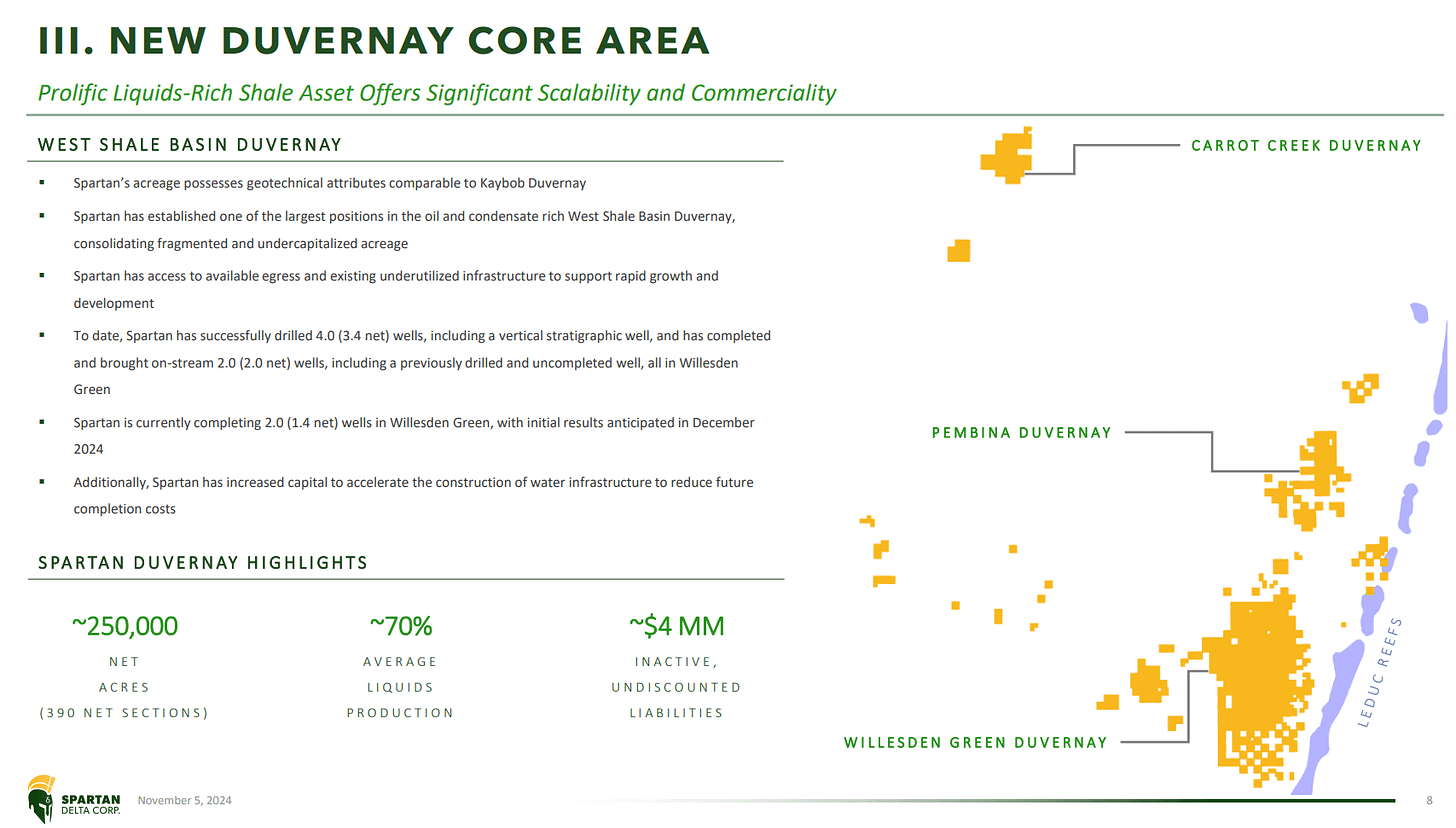

The second part of SDE's investment thesis is that the company has quietly amassed a large, 250,000-acre position in the Duvernay. The new position is largely undeveloped, and management’s plan is to prove that the acreage is high-quality. The new acreage position is shown in the slide below.

Source: SDE November 2024 Investor Presentation.

Last night, SDE published an operation update press release that disclosed its latest Duvernay well results. The wells were drilled by Journey Energy (JOY:CA), with which SDE formed a joint venture to develop a portion of its Duvernay acreage in a capital-efficient manner. The press release reported that one of two Duvernay wells drilled during the fourth quarter produced 1,166 boe/d, of which 1,019 bbl/d, or 87%, was comprised of 48-degree API (i.e., light) oil. The other well produced 1,029 boe/d, of which 865 bbl/d, or 84%, was 48-degree API oil.

These are impressive results that confirm management’s high expectations for SDE's new Duvernay acreage. The company says as much in the press release, stating that “the majority of its acreage is in the tier one oil and condensate rich Duvernay fairway with initial production results validating this thesis as production rates and flowing pressures are stronger than the nearest offsetting wells completed by the previous operator.”

Continued positive Duvernay will increase SDE’s exposure to oil prices, which we like as we’re bullish on oil prices over the next few years. More importantly, however, the results will prove the value of an asset that can be sold at a significant profit for shareholders.

We expect the company to report additional positive drilling results in 2025. Other operators in the area have made huge strides in improving their well results. Vesta Energy, for one, has achieved significant improvement in recent years as it adopted new completion designs. Since SDE is one of the best operators in Canada, we expect its team, in conjunction with joint venture partner Journey Energy, to continue to post strong results in the Duvernay using their own completion designs.

If drilling results continue to track with our expectations, we estimate that SDE’s Duvernay position is worth at least its current market cap of $690 million with WTI in the mid-US$70s per barrel range. We estimate the shares can double over the next two years due to the company’s cash flow at higher commodity prices and the likelihood that it unlocks its considerable asset value.